A business model that works today, is no guarantee for the future. Many smaller companies, but also larger organisations such as Kodak and Nokia, have experienced this. Will your service or product still be relevant in a few years, especially given rapid developments in artificial intelligence? And how about the GDPR that will go into effect in may 2018, will you be able to continue working as you do now? Innovating your business model is essential to remain relevant in the long term. Research in our European project ENVISION shows that 37% of the European SME's are working on business model innovation. The organisations doing this also seem to perform above average. In many cases though, the business model is seldom tested for being robust or futureproof. Which is a pity. By mapping recent developments in technology, legislation and the market and asking yourself what the impact is on your business model, you will be able to anticipate these future events. And make your business model more robust. Innovalor and TU Delft have developed a new technique to do this, the business model stress test. It is the first scientific and practical approach that evaluates the robustness of your business model.

Business Model Stresstest

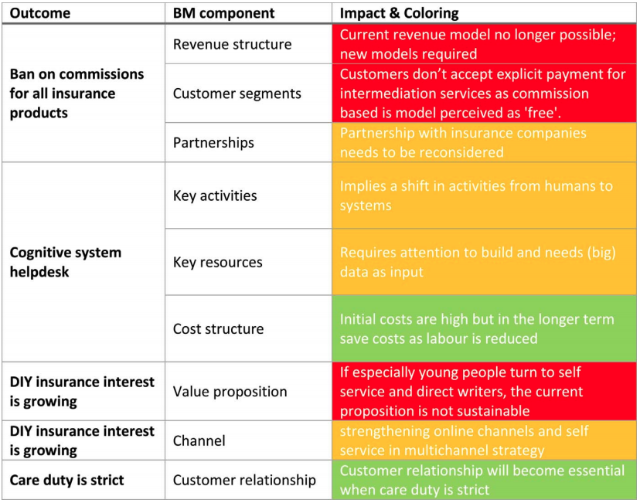

With the business model stresstest you confront your business model with the developments in the environment. You visualize the challenges for your business model in a 'heatmap' and discover ways to increase the robustness of your business model. This approach works with seperate component of the business model, such as value proposition, key activities or revenue model. But it also looks at the relationship between these components. The business model stresstest is done in four steps. In the first step, the business model is described and in the second step the relevant developments are collected. In step three, the actual stress test is done and step four is using the results of the stress test to improve the business models' robustness. The steps are described below, using an example from an insurance intermediary. The steps and example are taken from this paper:

Timber Haaker, Harry Bouwman, Wil Janssen en Mark de Reuver (2017). Business model stress testing: A practical approach to test the robustness of a business model, Futures, Volume 89, pp. 14-25.

Step 1: Describe your business model

Describe your business model in a structured format, such as the business model canvas or STOF business model. You will need the components of the business model to systematically evaluate it agains relevant trends and developments. In the paper your can find the business model canvas example for an insurance intermediary.

Step 2: Describe the relevant trends and developments

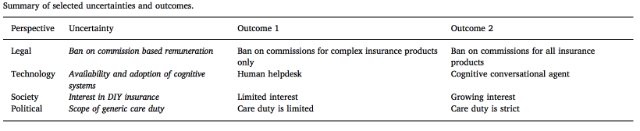

Select the most important developments that could have an impact on your business model. Keep in mind the trends of which you are certain and the developments for which the outcome is uncertain. An example of a certain trend is the aging population. Uncertain developments can be seen in macro-economics (hard/soft brexit) or legislation (how strict will privacy and data regulations become?) Reviews of trends and uncertainties can be found in trendreports business analyses, freely available on the internet. An easy way to create an overview of relevant development is a PEST analysis. Which helps cover relevant political, economical, social and technological developments. In case of uncertainties, keep in mind that there are several possible outcomes: